The Social Security Administration (SSA) is set to announce significant changes that will impact millions of retirees across the United States.

Following the highly anticipated Cost-of-Living Adjustment (COLA) announcement, the SSA has revealed two additional modifications that will reshape the financial landscape for beneficiaries in 2025.

COLA Announcement: The Prelude to Change

The SSA is poised to release the COLA for 2025, a crucial adjustment that helps Social Security benefits keep pace with inflation.

This announcement, eagerly awaited by retirees, has been slightly delayed due to the need for September’s final inflation data, which will be available on October 10.

Two Key Changes Unveiled

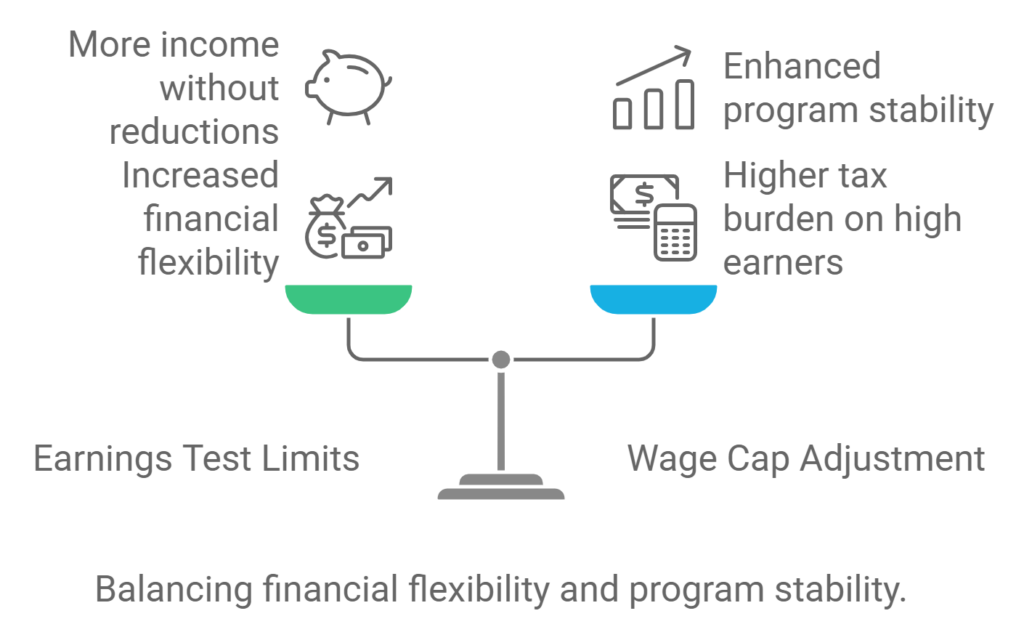

1. Revised Earnings Test Limits

The SSA is set to adjust the earnings test limits, a move that will significantly impact working retirees. These limits determine how much a beneficiary can earn without facing reductions in their Social Security payments.Current Limits:

- For 2024, the earnings test limit is $22,320 for those below full retirement age

- A higher limit of $59,520 applies to individuals reaching full retirement age in 2024

Expected Changes:

- The 2025 limits are anticipated to increase, allowing retirees to earn more without benefit reductions

- This adjustment aims to provide greater financial flexibility for working beneficiaries

2. Updated Social Security Wage Cap

The second major change involves the Social Security wage cap, which affects both current workers and the overall stability of the Social Security system.Current Wage Cap:

- For 2024, the wage cap stands at $168,600

Projected Modifications:

- The 2025 wage cap is expected to rise, reflecting inflation and wage growth trends

- This increase will subject a larger portion of high earners’ income to Social Security taxes

- The adjustment aims to bolster the long-term financial health of the Social Security program

Implications for Retirees and Workers

These changes will have far-reaching effects on both current retirees and future beneficiaries:

- Working retirees may have more earning potential without facing benefit reductions

- Higher wage earners will contribute more to the Social Security system

- The increased revenue could help address potential future shortfalls in the program

- Retirees may see improved long-term stability in their benefits

What to Expect

As October 10 approaches, retirees and workers alike should prepare for these significant updates. The SSA’s announcements will provide crucial information for financial planning and decision-making in the coming year.